Robotic Process Automation (RPA) for finance is changing the Finance and Automation (F&A) function. It is now possible to remove most of the manual work and help talented F&A team members focus on business growth.

Would you like to radically improve your cost efficiency? Are you looking to innovate and improve speed and accuracy? Would you like to utilize your Finance team better?

Read on to understand how Robotic Process Automation (RPA) can do that for you and get up to 20 to 60% cost savings on baseline FTE costs.

What is Robotic Process Automation (RPA)?

Robotic Process Automation is a capability that allows you to carry out tasks on a computer just like a human would. If you are new to RPA, read here for the complete beginner guide.

Robotic Process Automation for Finance & Accounting

Current Automation technologies that includes RPA and AI can fully automate 42% of the F&A tasks as per a McKinsey study. Note that it says “fully” automate these tasks. Another 19% of the tasks can be mostly automated as per the same study.

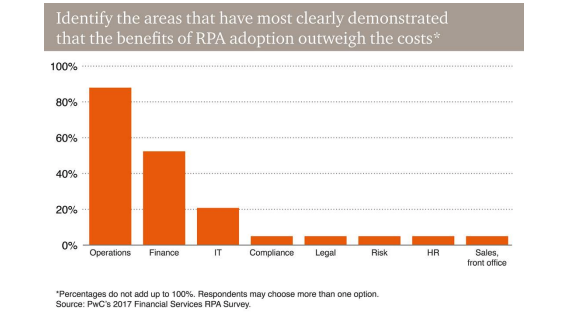

Finance is the area with the most demonstrated benefits right after operations as per PWC’s 2017 Financial services RPA Survey.

An overwhelming 98% of respondents agree that developing an RPA program is important, very important, or extremely important –PWC’s 2017 Financial services RPA Survey.

How does RPA help?

RPA offers finance departments many short and long-term benefits.

Cost Savings: RPA provides around 20to 60% savings on the baseline people cost.

Accuracy: Increased output quality by reducing or eliminating human error.

Faster Task completion: Helps bring down the time to perform tasks significantly.

More Control: Provides fully maintained logs essential for compliance

Employee motivation: Lets employees focus on business activities that they were unable to do due to manual tasks.

Robotic Process Automation for Finance – use cases

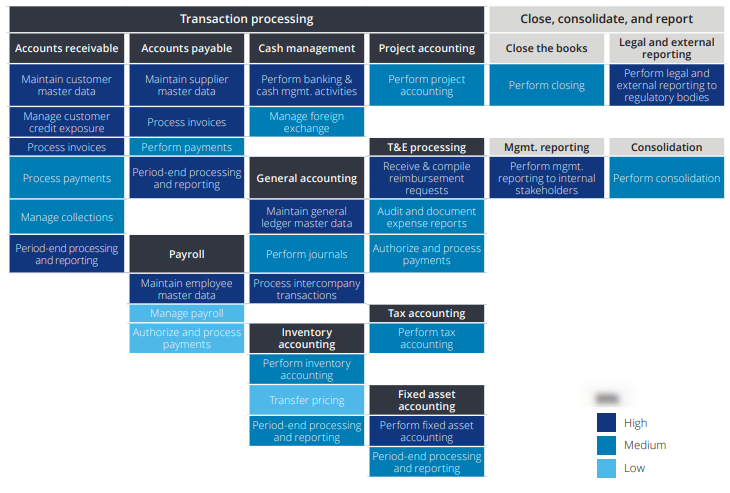

There are opportunities to automate across all areas of finance sub-functions. Most of the repetitive transactional activities are good candidates for automation.

To get a sense of what can be achieved, here are a few activities that can be automated with RPA by area.

Accounting:

- Automate journal entries: RPA can process email, perform compliance checks and process the Journal entries in ERP (SAP, Oracle etc.), and notify the requestor.

- Account reconciliations: RPA can automate the download of sub-account balances, perform validations and create balancing journal entries to handle discrepancies

Accounts Payable:

- Automate workflow and approvals: RPA can be configured for rules-based auto approval in the AP system. Any exceptions are raised to the appropriate person for manual approvals.

- Invoice processing: Capture invoice data from scanned invoices or electronic files and process the same in ERP systems. The invoice processing time can be reduced by unto 60 to 80 %.

Accounts Receivable:

- Payment matching & processing: Bank lockbox payments received from various sources are matched against open invoices. These are then processed in the ERP system and remittance receipts generated.

- Customer onboarding: Create and update customer master data. Automatically check for credit approvals.

Payroll

- Time record validation: Following up on missing timesheets, validate time booked and notify any discrepancies.

- Earnings and Deductions: Initiate batch creation and imports into the payroll system, complete the standard validations.

Financial planning and reporting

- Financial planning and analysis: Prepare forecasts automatically using historical and market data, load pre-populated balances into the planning system, Create variance reports

- Regulatory reporting: Capture and cleanse data, generate the regulatory reports automatically. Create complex annual reports to the extent possible.

These are some typical use cases for RPA in F&A. Every finance organization is unique, and a discovery process can help unearth opportunities to automate.

How to get started with Robotic Process Automation for Finance

![]()

Since RPA is a business tool that can be implemented quickly, you can dive right in. Most of the organizations start with an inventory of all Finance and Accounting processes that are repetitive and have a lot of manual work. You can look for inspiration from the subfunction and use cases above.

Once the processes are identified, pick a simple but visible process to Pilot. Once the pilot is successful, pick more processes from the inventory and implement the next batch using agile methods.

Gartner recommends that finance leaders explore the areas of their business that can be quickly automated and standardize these processes as they go. This will allow a much speedier process for adoption of robotics within finance departments, the majority of which will implement RPA in some fashion by 2020.

Robotic Process Automation for finance – What’s next?

There is a lot of excitement around RPA. Many Finance and Accounting teams are embracing automation to improve their sub-functions. RPA is a fantastic opportunity for F&A organizations to focus on driving efficiency.

While this is a great development, there are instances when the finance organizations do not see the results that were expected. “Without knowing their true pain points or support requirements, companies will miss out on ways to scale the benefits, and they’ll leave money on the table.” A report from PricewaterhouseCoopers (PwC) highlights.

So, it is best to start your automation journey systematically. Finance and accounting teams that understand, plan, and build automation into their roadmap will be well positioned for the future.

Need help starting the journey? Contact me.

Thanks for this article and I recently did a RPA starter course from UiPath and after this I am also regular working on RPA and glad to connect with you because you are providing a good help related to my area.

Keep sharing your valuable content on RPA

Thank you Deepanshi. Appreciate your feedback.